Financial planning starts with your Best Days.

Most wealth managers focus on spreadsheets. We focus on the life you want to live. Because building wealth without meaning is just collecting numbers.

Start by discovering your personal approach to wealth with our Money Mindset Quiz!

Our Best Days Approach

Your money should make more possible — more moments, more milestones, more Best Days.

We start by getting to know what matters most to you, then create a plan that aligns every financial decision with your vision for the future.

What You Can Expect

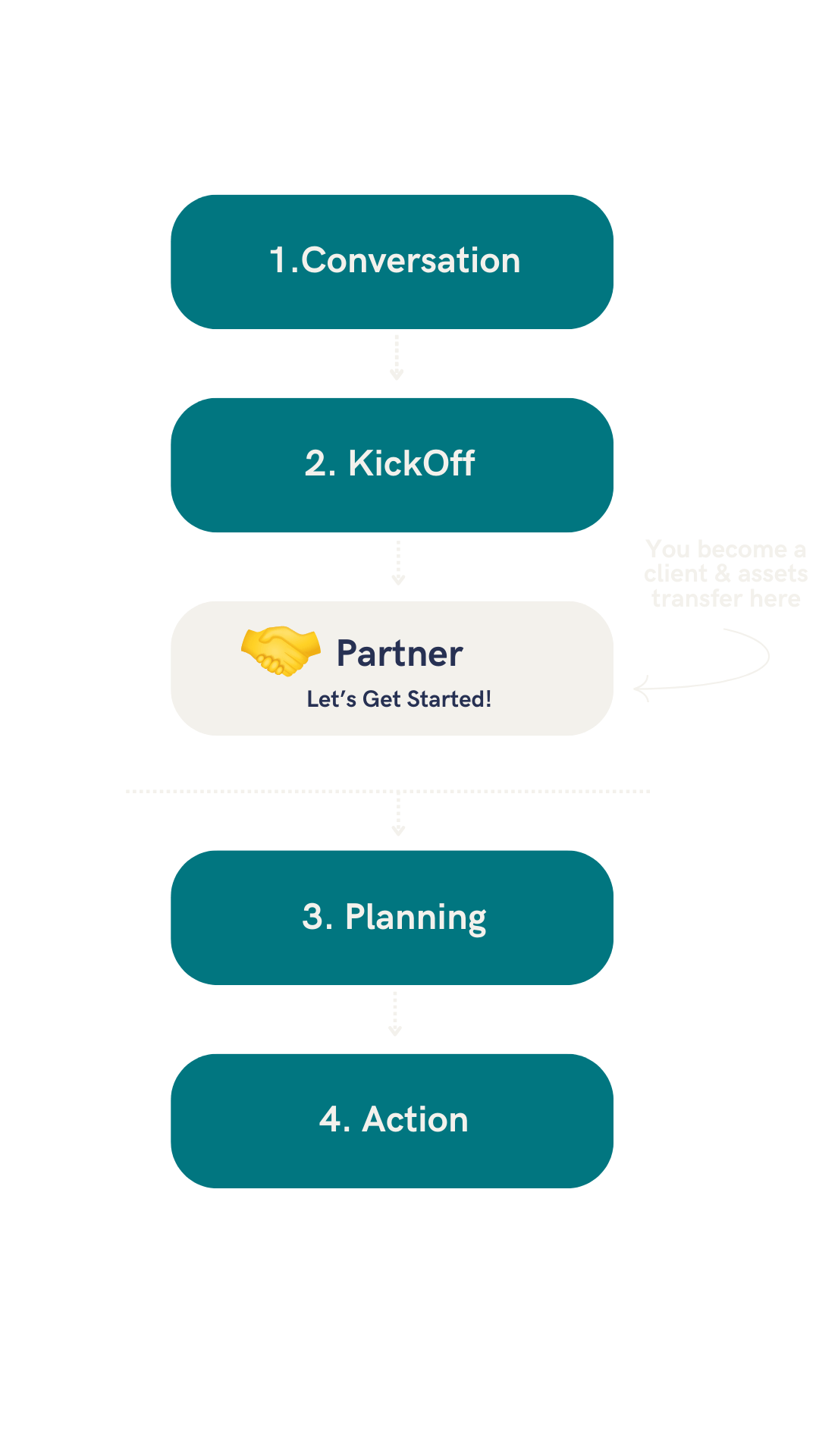

Conversations that put your values first.

In our initial meeting, I want to find out what is important to you and your family.

A Best Days Blueprint built around your life goals.

After our Kickoff call, we get to work building a blueprint that aligns with more Best Days for you and your family.

Clear, evidence-based strategies for every recommendation.

During our Planning Process, we will stress-test each strategy and provide clear next steps to move forward with confidence.

Ongoing guidance so your plan grows with you.

We are committed to you even after your plan is in place. We are committed to regular check-ins and communication to ensure you are sully supported.

Our Services

For Individuals, Families, Institutions, and Non-profits

INVESTMENT SERVICES

Equities

Mutual Funds

Exchange Traded Funds (ETFs)

Money Market

Treasury Bills/Bonds

Agency Note

Municipal Notes/Bonds

Corporate Bonds

Brokered CDs/Market-Linked CDs

401(k), Pension and Other Retirement Plans

Digital Assets

Financial and Estate Planning

Asset Allocation and Portfolio Design

Dynamic Portfolio Management

Retirement Income Planning

Stock Option Planning

Trust Planning

Performance Reporting and Account Aggregation

PRIVATE WEALTH MANAGEMENT

Alternative Investments

Commercial Paper

Margin Loans

Self-Directed Brokerage Accounts

Trust Services

Life Insurance

Disability Insurance

Long-Term Care Insurance

Annuities

Cash Management Services

Retirement Plan Services

Executive Compensation Strategies

Business Transition Planning

Charitable Planning

Insurance Analysis (Life, Disability, Long-Term Care)

College Education Planning

Who We Are

ADVISORS WHO UNDERSTAND FAMILY

We believe great financial planning starts with understanding who you are—not just your numbers. Ryan and Rebekah bring deep expertise in wealth management, but what truly drives their work is building genuine partnerships with families.

Built differently. We're not a large firm with assigned advisors you'll never see again. We're siblings committed to being your long-term partners—understanding your family's unique situation and evolving your strategy as life changes.

Here's how it works: Ryan is your primary advisor for financial planning and investments. Rebekah ensures your entire experience is seamless and supportive. Together, they're dedicated to helping you feel confident about your future.

Ryan Heath

Founder, Lead AdvisorRyan starts every relationship by getting to know what matters most to you—your values, your goals, and what your 'Best Days' look like.

With 20+ years building top wealth management firms, he brings deep expertise in creating comprehensive financial plans.

But rather than starting with spreadsheets, he builds your strategy around your life story—designed to protect what's important and help you feel confident about your future.

His goal is to turn your financial strategy into freedom to pursue your Best Days.

Founder, Client SpecialistRebekah Tozer

Rebekah ensures every aspect of your financial journey—from planning to ongoing updates—is clear, organized, and built around what matters to you.

With expertise in systems, strategy, and communication, she translates complex financial concepts into straightforward guidance you can actually understand and act on.

She's passionate about helping families feel confident in their plan, so they can focus on living their Best Days with less worry and more intentional choices.

OUR STORY

Rooted in Legacy. Focused on Your Future.

FJ Shaw is more than a name. It’s a family story, built on the values of trust, integrity, and connection.

We named our firm after our grandfather, Frank Shaw — a man whose wisdom, character, and commitment to family still guide us today. Just as he invested in people, we invest in building meaningful relationships with our clients.

We believe financial planning should be personal. Our role is to connect the dots between your wealth and the life you want to live, helping you create more of your Best Days along the way.

Our Commitment to You

We Listen First – Your goals, priorities, and values set the direction.

We Keep It Clear – No jargon. No confusion. Just straightforward guidance.

We Stay By Your Side – Through every milestone and every change in your journey.

Let’s Get Started

Ready to Meet?

Schedule a brief virtual meeting with Ryan.

Questions?

Not sure where to begin or have questions?Send us a quick message!